Comparing Interest Rates in the US, Canada, England, and Europe: A 10-Year Perspective and Recent Trends

Exploring Central Banks' Monetary Policies and Their Impact on Inflation, Employment, and Market Dynamics

Introduction

In this post, we analyze the historical interest rates of the US, Canada, England, and Europe over the past 10 years and explore recent changes made by central banks. We've compiled data from central banks, merged it, and presented key comparisons in the following charts.

Data Sources

Below are the links to the data sources used for this analysis:

Bank of Canada Interest Rate (WOWA)

Federal Reserve Target Rate Upper Bound (FRED)

Federal Reserve Target Rate (FRED)

Federal Reserve Target Rate Lower Bound (FRED)

Federal Reserve Open Market Operations

Bank of England Bank Rate Database

Key ECB Interest Rates (ECB Data)

Reserve Bank of Australia Cash Rate Chart

S&P/TSX Composite Index Historical Data (Yahoo Finance)

Bank of Canada Legacy Noon and Closing Rates

Bank of Canada Daily Exchange Rates

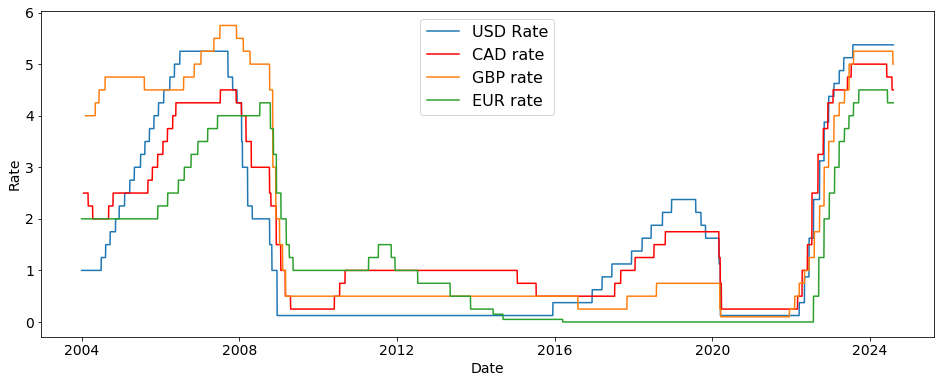

10-Year Interest Rates Chart

Recently, the Bank of Canada, the Bank of England, and the European Central Bank have made the strategic decision to decrease their target rates, signaling a shift in monetary policy. This follows a global trend, where central banks are recalibrating their rates in response to evolving economic conditions. With US inflation easing, especially with headline CPI falling below 3% in July 2024 for the first time since March 2021, the Federal Reserve is expected to follow suit. A 25-basis point cut is anticipated in the September 2024 meeting, although the upcoming CPI report will be pivotal in solidifying this decision.

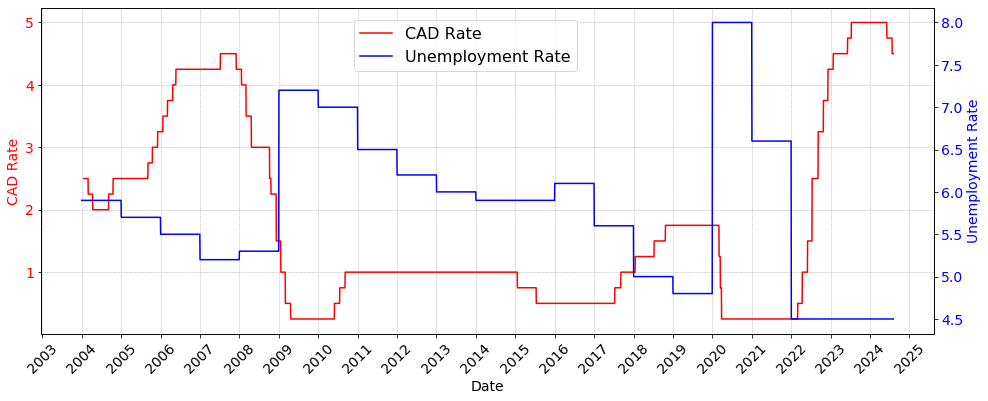

CAD Rate and Unemployment Rate

The Bank of Canada's recent rate cut aligns with the labor market's current dynamics, as employment remains a focal point for the central bank amid a cooling inflation landscape.

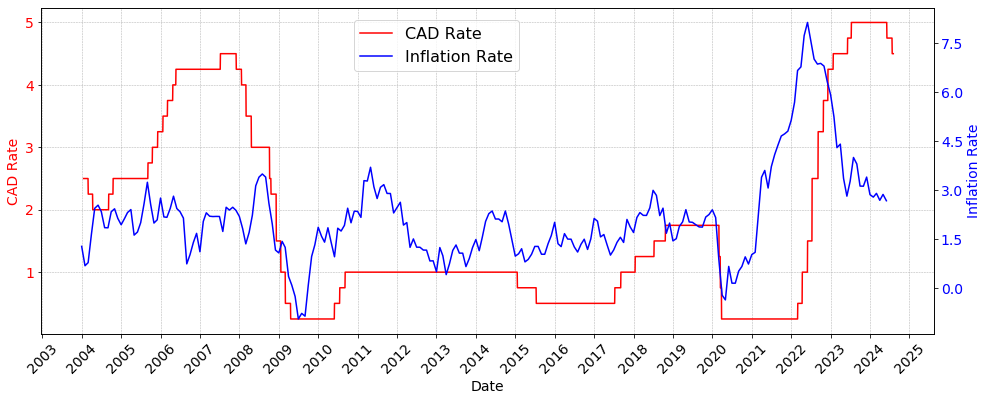

CAD Rate and Inflation Rate

With goods deflation deepening, the Bank of Canada's move to reduce rates reflects concerns over weaker consumer demand, aiming to balance inflationary pressures.

Conclusion

The global landscape of interest rates is undergoing significant changes, driven by central banks' responses to inflation dynamics and economic activity. Monitoring these developments will be crucial for understanding their broader implications on markets and the economy.

Full Code Reference

For the full code and further details, visit my GitHub repository:

https://github.com/talezadeh/interest-rates